Mitsubishi Motors Philippines Corporation and MarCoPay Inc. have signed a business alliance agreement, bringing about a move to strengthen the connection between the Philippine automotive sector and its burgeoning maritime industry.

Their mission: Make vehicle loans easier for Filipino seafarers.

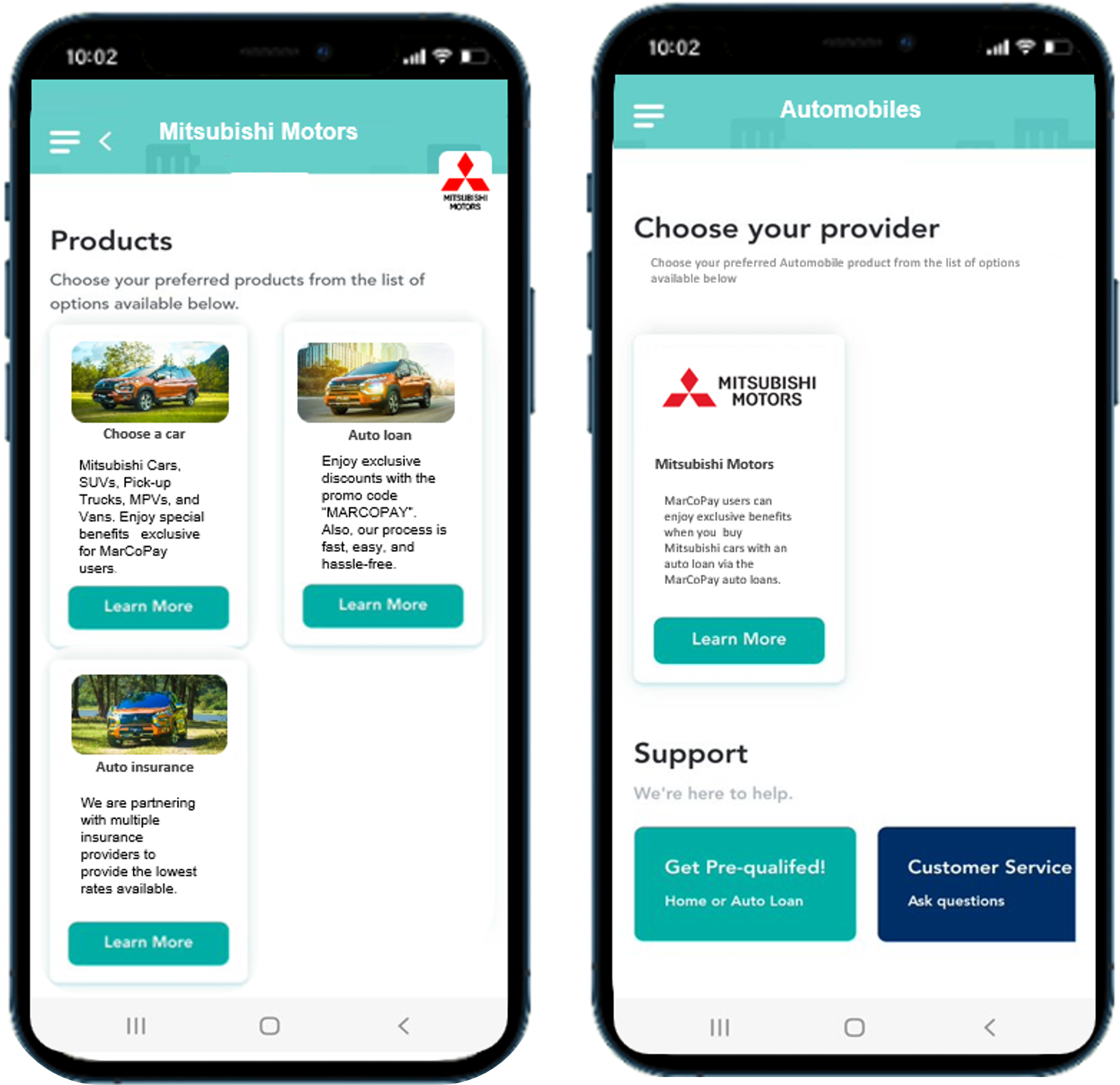

This partnership aims to promote new vehicle sales to the significant population of Filipino seafarers via the MarCoPay mobile app, with sales already beginning last July.

The Philippines has established itself as one of the world’s foremost suppliers of seafarers, boasting about 200,000 Filipino seafarers on oceangoing cargo ships.

This figure extends to Japan’s merchant fleet, where approximately 70 percent of all seafarers on board, around 40,000 individuals, are of Filipino origin.

It is factual to state that Filipino seafarers form the backbone of the shipping industry in Japan and globally.

Despite their essential role and earning well above the average income in their home country, Filipino seafarers often find themselves ensnared in complicated financial challenges.

Securing vehicle loans has traditionally been a struggle for them, given their classification as term employees or expatriates, leading to intricate paperwork and hurdles with bank processing.

MMPC has a significant presence in the country’s automotive landscape, maintaining business relationships with 70 suppliers and 26 dealer groups.

In parallel, MarCoPay Inc., a Nippon Yusen Kabushiki Kaisha group company, was established in 2019 to address the financial needs of Filipino seafarers.

Through its financial platform, it serves them with payroll payment in electronic currency, remittance, exchange functions, and preferential conditions, including various loans and insurance options.

In 2022, the company collaborated with local banks to introduce

MarCoPay-affiliated loans, aiming to improve the auto loan approval rate for seafarers, coupled with offering competitive products and interest rates in the Philippine market.